Your Ultimate Shield Against Corporate Transparency Act (CTA) Compliance Risks

Non-compliance with the CTA could lead to severe penalties, putting your business and clients at risk. Beneficial Owner Filing, LLC offers a comprehensive, one-stop solution to ensure you meet every CTA requirement swiftly and securely. Our industry-leading platform is the fastest and most powerful tool available, designed to keep you compliant now and in the future.

What is the Corporate Transparency Act (CTA) Compliance

The Corporate Transparency Act (CTA) mandates that U.S. businesses report detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This is aimed at combating illicit activities like money laundering and tax evasion and increases transparency in business ownership.

Key Requirements

Beneficial Ownership Reporting

Filing Deadlines

Key Deadlines

Existing Entities: Must file by December 31, 2024.

New Formations After January 1, 2024: Must file within 90 days of formation.

New Formations After January 1, 2025: Must file within 30 days of formation.

Penalties for Non-Compliance

Civil Penalties

Criminal Penalties

Operational Risks

What Is The Office Of Foreign Asset Control(OFAC) Compliance

The Office of Foreign Assets Control (OFAC) administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals. Compliance with OFAC regulations is mandatory for businesses operating in the United States. OFAC regulations apply to all U.S. persons and businesses, including those operating overseas

Key Requirements

Sanctions Screening

Regularly screening customers, vendors, and transactions against OFAC’s list of sanctioned individuals, entities, and countries.

Due Diligence

Conducting thorough due diligence to ensure no dealings with prohibited parties.

Reporting

Reporting any blocked transactions or prohibited dealings to OFAC.

Penalties for Non-Compliance

Severe civil fines

That can reach millions per violation.

Criminal Penalties

Substantial fines and imprisonment.

Business Impact

Frozen assets, blocked transactions, and irreparable reputational damage.

Registered Agents at Risk

Operational Risks

As a registered agent, failing to comply can lead to blocked transactions and loss of client trust.

Screening Obligations

As a registered agent, you must conduct through due diligence to ensure that you clients are not engaging in prohibited transactions.

Why Choose Beneficial Owner Filing, LLC ?

Trusted Expertise

At Beneficial Owner Filings LLC, we offer unmatched compliance expertise. Our team has long worked with:

FinCEN’s FBAR.

The Department of Treasury (IRS & OFAC)

Secretary of State processes

Our expertise and our team’s deep knowledge are our greatest assets. With decades of experience, we help ensure accurate filings and seamless compliance

Fast and Secure

Our platform ensures you meet deadlines effortlessly.

Expert Support

Professional guidance to navigate CTA requirements smoothly.

Streamlined Process

Simplified filings for both existing entities and new formations.

Who Needs to Comply?

Law Firms

Ensure timely CTA compliance for your clients.

Accountants

Protect your clients from financial and legal risks.

Business Owners

Avoid fines and operational setbacks.

Protect Your Business

Begin your compliance process with Beneficial Owner Filings LLC today to fully protect your business and clients under the CTA

Choose Beneficial Owner Filing, LLC for Efficient and Hassle-Free Filings

Beneficial Owner Filing, LLC Is Your Partner In Risk Mitigation.

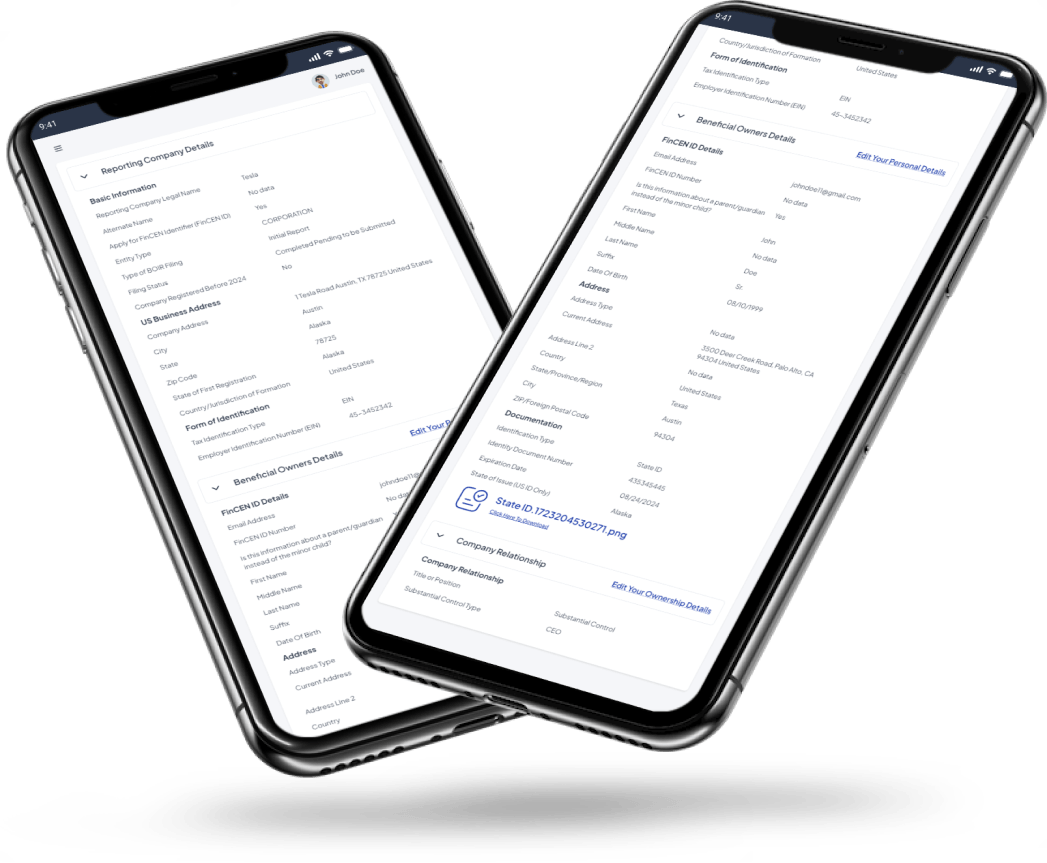

How Will the CTA Process Work?

Gather Essential Information

Collect Entity, Beneficial Owner, and Company Applicant details.

Create an Account

Securely set up your profile on our platform.

Invite or Enter Information

Send email invites for Beneficial Owners and Company Applicants to input their data, or manually enter it yourself.

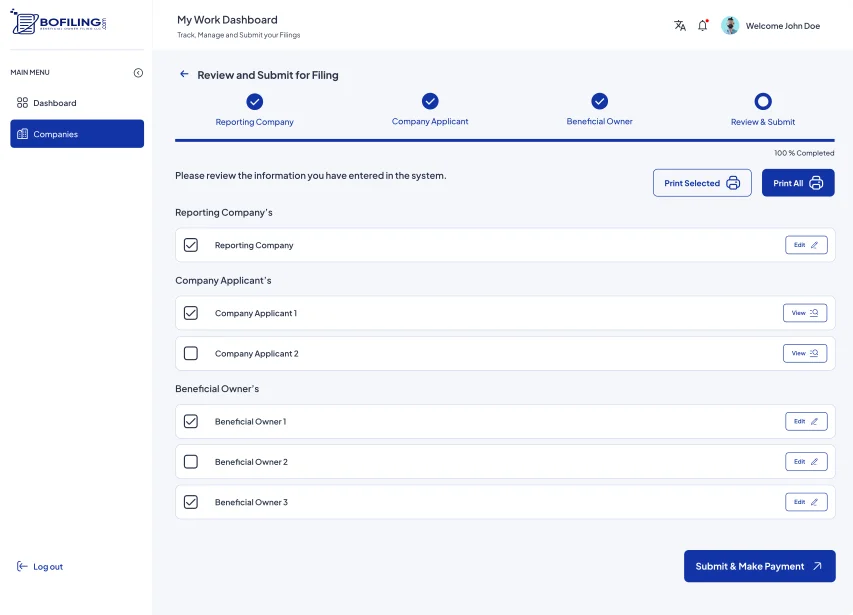

Review Reports

Ensure accuracy by reviewing the Beneficial Owner Information Report (BOIR).

Submit to FinCEN

Comply with ease and receive immediate confirmation.

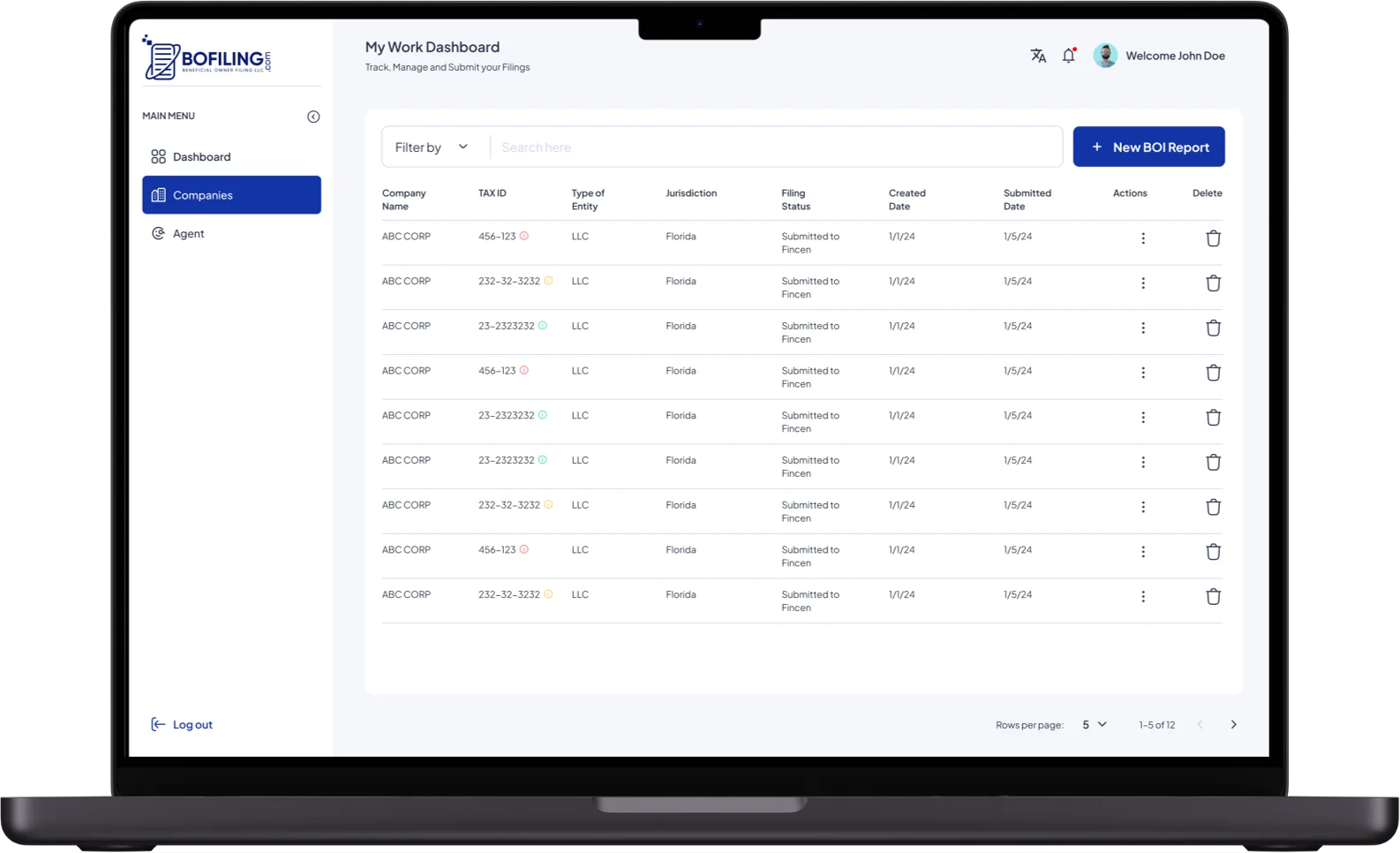

Monitor in Dashboard

Stay informed with real-time tracking.

Manage and Amend

Easily view, print, and amend information as required.

Securely Manage Data

Keep all entities and data organized within our platform.

Beneficial Owner Filing, LLC Dashboard – Your Command Center for CTA Compliance

CTA-Specific Solutions – Achieve compliance without breaking the bank

What You Can Expect from Beneficial Owner Filing, LLC

Easy-to-use Forms

Online Access to Reports

Dashboard Management

Expert Help and Support

Efficient and Accurate Work

Cost-effective Solutions

What we Do

Check out some of our Professional Services!

Beneficial Owner Filing, LLC Dashboard – Your Command Center for CTA Compliance

The Beneficial Owner Filing, LLC dashboard is designed to make your CTA compliance management seamless, efficient, and secure, providing all the tools you need to stay compliant and avoid costly penalties.

Quick Links